Off-Site Levy

On this page:

The monies collected by the Off-site Levy are used to build infrastructure that supports new developments. There are three offsite levies: water, sanitary sewer and transportation.

The basic principle behind the Off-site Levy is that growth pays for growth.

The current off-site levy is set by Bylaw No. 2099. Policy P-61-06-E provides added direction respecting when the levy is applicable and how the Town takes levy payment.

Current Levy Rates

| Area Ref # | Road Off-Site Levy (per Ha) | Water Off-Site Levy (per Ha) | Sanitary Sewer Off-Site Levy (per Ha) | Total (per Ha) |

|---|---|---|---|---|

| 1 | $16,209 | $8,221 | $10,932 | $35,362 |

| 2 | $16,209 | $8,221 | $10,932 | $35,362 |

| 3 | $16,674 | $8,221 | $10,932 | $35,827 |

| 4 | $16,209 | $8,221 | $10,932 | $35,362 |

| 5 | $16,209 | $8,221 | $10,932 | $35,362 |

| 6 | $16,209 | $8,221 | $10,932 | $35,362 |

| 7 | $16,209 | $8,221 | $10,932 | $35,362 |

| 8 | $16,674 | $8,221 | $10,932 | $35,827 |

| 9 | $18,635 | $8,221 | $10,932 | $37,788 |

| 10 | $16,209 | $8,221 | $10,932 | $35,362 |

| 11 | $16,209 | $10,127 | $13,095 | $39,431 |

| 12 | $16,209 | $10,127 | $13,095 | $39,431 |

| 13 | $16,209 | $10,127 | $13,095 | $39,431 |

| 14 | $16,209 | $8,221 | $10,932 | $35,362 |

| 15 | $18,170 | $8,221 | $10,932 | $37,323 |

| 16 | $16,674 | $8,221 | $10,932 | $35,827 |

| 17 | $16,209 | $8,221 | $10,932 | $35,362 |

| 18 | $16,209 | $10,127 | $13,095 | $39,431 |

| 19 | $16,209 | $10,127 | $13,095 | $39,431 |

| 20 | $16,625 | $8,221 | $10,932 | $35,778 |

| 21 | $16,625 | $8,221 | $10,932 | $35,778 |

| 22 | $16,625 | $10,127 | $13,095 | $39,847 |

| 23 | $16,209 | $8,221 | $10,932 | $35,362 |

| 24 | $16,209 | $10,127 | $13,095 | $39,431 |

| 25 | $16,209 | $10,127 | $13,095 | $39,431 |

| 26 | $16,209 | $10,127 | $13,095 | $39,431 |

| 27 | $16,674 | $10,127 | $13,095 | $39,896 |

| 28 | $16,209 | $10,127 | $13,095 | $39,431 |

| 29 | $16,209 | $10,127 | $13,095 | $39,431 |

| 30 | $16,209 | $10,127 | $13,095 | $39,431 |

| 31 | $16,209 | $10,127 | $13,095 | $39,431 |

| 32 | $15,879 | $8,221 | $10,932 | $35,032 |

| 33 | $16,625 | $10,127 | $13,095 | $39,847 |

| 34 | $19,051 | $10,127 | $13,095 | $42,273 |

| 35 | $16,625 | $10,127 | $13,095 | $39,847 |

| 36 | $17,090 | $10,127 | $13,095 | $40,312 |

| 37 | $15,879 | $8,221 | $10,932 | $35,032 |

| 38 | $15,879 | $8,221 | $10,932 | $35,032 |

| 39 | $16,625 | $11,866 | $9,086 | $37,577 |

| 40 | $19,051 | $11,866 | $9,086 | $40,003 |

| 41 | $18,635 | $11,866 | $9,086 | $39,587 |

| 42 | $18,586 | $11,866 | $9,086 | $39,538 |

| 43 | $16,210 | $11,866 | $9,086 | $37,162 |

| 44 | $18,586 | $15,432 | $12,652 | $46,670 |

| 45 | $26,674 | $15,432 | $12,652 | $54,758 |

| 46 | $19,051 | $15,432 | $12,652 | $47,135 |

| 47 | $16,625 | $15,432 | $12,652 | $44,709 |

| 48 | $16,625 | $15,432 | $12,652 | $44,709 |

| 49 | $16,210 | $11,866 | $9,086 | $37,162 |

| 50 | $16,210 | $8,221 | $13,095 | $37,526 |

| 51 | $16,210 | $8,221 | $13,095 | $37,526 |

| 52 | $16,625 | $10,127 | $13,095 | $39,847 |

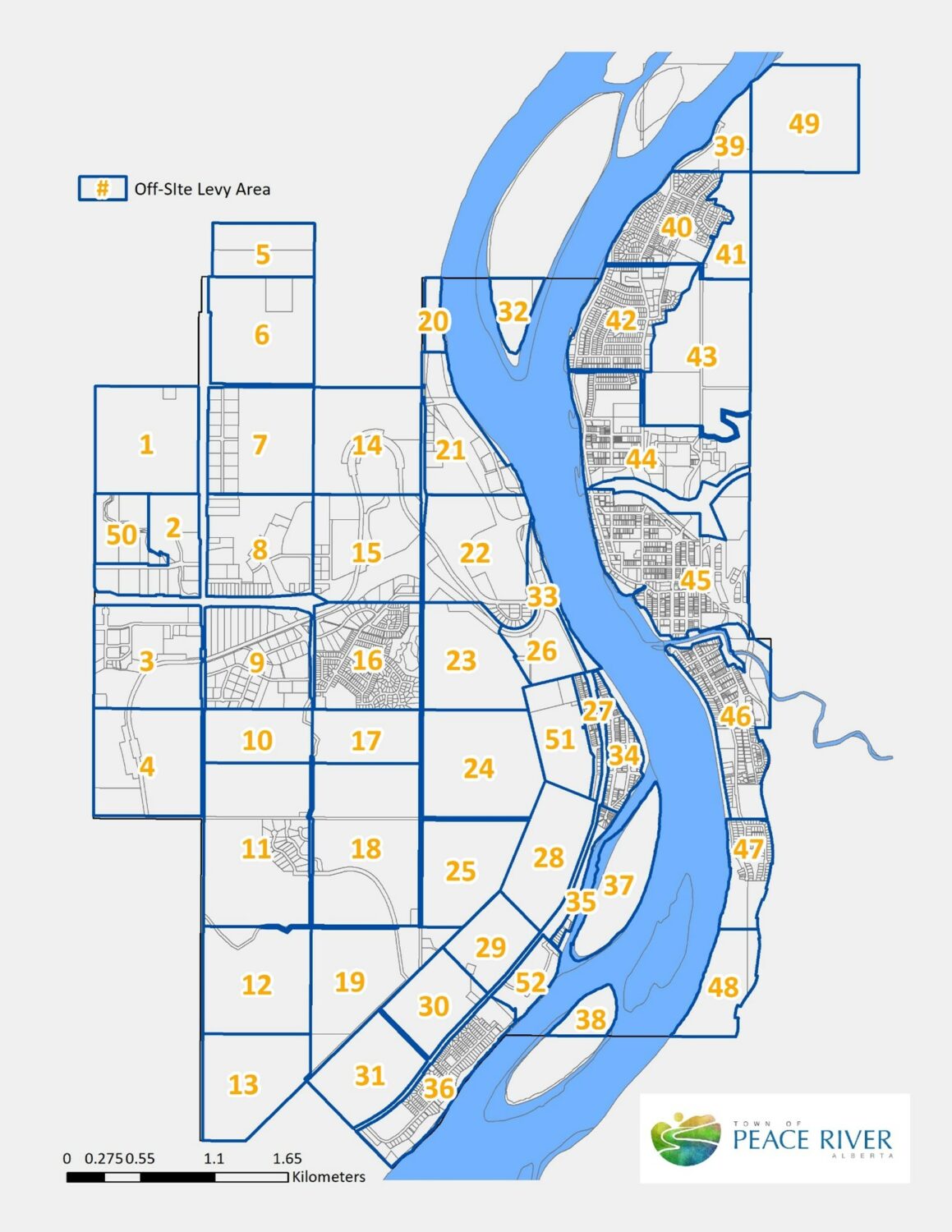

Current Levy Areas

The updated off-site levy areas (Schedule A of the bylaw) is below:

Frequently Asked Questions and Comments

How much do I have to pay?

It depends.

Contact Planning and Development to confirm what levies apply based on the specifics of your proposal.

The rates are calculated on a per hectare basis on the levy area. There are three offsite levy rates – water, sanitary sewer and transportation – for each area. Whether all three rates are applicable depends on whether the development is connected to municipal systems. The amount of land that the levy will apply to depends on the specific details of the development. The off-site levy is not applied to environmental reserve land, municipal reserve land or land for a road.

Examples

The examples below are meant to illustrate some of the ways that the OSL policy influences when the levies apply and are owing. They are provided for example only and do not bind the Town to a specific interpretation of the policy.

Proposal 1: To develop 1 house on an unserviced 16-hectare parcel.

Assumptions: Applicability Threshold 8.19 and 8.20 of the OSL Policy apply.

Bottom line: The minimum levy where 8.19 and 8.20 apply would be a transportation levy based on 0.1 hectares, if the yard site (including the driveway) is 0.1 hectares or less. If the yard site of the development is larger than 0.1 hectares, then the levy would correspondingly be larger as well (e.g. 0.5 hectare yard site).

Proposal 2: Subdivide 10-hectare parcel into 2 equal size parcels.

Assumptions: Applicability Threshold 8.15 of the OSL Policy applies.

Bottom line: The levies do not apply at subdivision. The subdivision can be registered at land titles without the payment of an OSL.

Proposal 3: Subdivide 10 hectare parcel into one 2 hectare lot and one 8 hectare parcel, and develop at house on the 2-hectare parcel.

Assumptions: Applicability Threshold 8.15 and 8.20 of the OSL Policy applies.

Bottom line: Per 8.15, the offsite levy may not apply at subdivision. At development the levy would apply to a minimum of 0.1 hectares, up to the full 2 hectares depending on how the parcel is developed. If the parcel is connected to all municipal services, then all three levies will apply. If the parcel has onsite water and sanitary sewer, then only the transportation levy will apply.

Proposal 4: Develop a restaurant in an existing building that was previously a retail store.

Assumptions: Applicability Threshold 8.18 of the OSL Policy applies.

Bottom line: The OSL does not apply for a development permit that changes of the use of an existing building.

Proposal 5: To demolish an old house and develop a semi-detached building with 2 dwellings on a parcel.

Assumptions: Applicability Threshold 8.9 of the OSL Policy applies.

Bottom line: The OSL does not apply.

When do I have to pay?

Off-site levies become owing only at subdivision approval or before a development permit is issued. The off-site levy must be paid before the start of a development or prior to subdivision registration at the Land Titles Office.

There are some subdivision and development permit situations where no off-site levy applies.

The levy is too high and prevents new development.

Over the last decade the Town has heard the critique that the levy makes developing in the Town more difficult. We acknowledge that the levy is an additional cost on the developer. The intent is that the levy will cover the additional cost of development on the Town, so that the existing rate payers are not required to pay for costs created by new development.

Over the last decade the Town has worked to improve the assumptions that influence that off-site levy model, which is used to determine the levy rates. Through this process, levy rates have decreased from a high of $83,355 / hectare (approximate weighted average rate) in 2016 to the current rate of $37,297 / hectare (approximate weighted average rate).

Table 2 Off-site levy rates since 2014

| Year | Rate Adjustment in Each Area | Approximate Weighted Average Rate |

|---|---|---|

| 2014 | 70% of Full Cost Rate | $58,348 |

| 2015 | 85% of Full Cost Rate | $70,852 |

| 2016 | 100% of Full Cost Rate | $83,355 |

| 2019 | 100% of Full Cost Rate | $40,886 |

| 2021 | 100% of Full Cost Rate | $37,297 |

The Town has also improved the policy, which identifies subdivision and development situations where the levies do not apply.

The levy should be removed.

The Town has had an off-site levy bylaw since the late 1970s. Removing the off-site levy would create legal and financial risk to the Town.

What areas in Peace River are affected by the Off-site Levy Bylaw?

The Off-site levy model covers all areas of the town.

Why wasn’t there a caveat on the title to warn me that an off-site levy is outstanding?

The Town of Peace River cannot register a caveat for such a purpose.

How will I know if I have to pay an off-site levy?

If you want to know whether an off-site levy payment will be required for a particular development or subdivision, contact the Planning Department at 780-624-2574.

How often is the levy updated?

Levy rates are updated every second year. The next rate update is expected in 2023.

How often do I have to pay an off-site levy?

Off-site levies only apply at subdivision or development. If you are not undertaking one of those processes, the levy won’t becoming owning through other processes. Each levy can only be levied once. I.e. once the transportation off-site levy is paid, a future subdivision or development will not “retrigger” another transportation off-site levy.

2021 Open House

The off-site levy was updated 2021. As a part of the update process, an online open house was held where changes to rate model, bylaw and policy were presented. See the presented information here:

Off-Site Levy History

The Town of Peace River has had an off-site levy in place since May 1978. Off-site levy rates have been set using the current approach, a rate model developed by CORVUS Business Advisors, since 2009. The off-site levy report associated with each bylaw outlines the methodology used in updating and establishing offsite levies and the resulting rates for each infrastructure type and each offsite levy area.

Table 1 Off-Site Levy Bylaw History

| Bylaw 1036 | 08-May-78 |

| Bylaw 1193 | 29-Dec-82 |

| Bylaw 1360 | 11-Jul-88 |

| Bylaw 1851 | 23-Nov-09 |

| Bylaw 1929 | June 10, 2013 Amends Bylaw 1851 |

| Bylaw 1952 | May 25, 2015 Amends Bylaw 1851 |

| Bylaw 2044 | 13-May-19 |

In April 2014, the Town retained CORVUS Business Advisors to facilitate a rate update. The average approved rates called for an adjusted rate (70% of the full amount) in 2014 totaling $58,348 per hectare and increasing to 100% of the full amount totaling $83,355 in 2016.

For the 2019 update, Town staff continued to use the CORVUS model and made several enhancements to the existing methodology. Capital projections over 25 years have been rationalized, as have the portions attributable to future development. As such, the rates show a significant reduction to an average rate of $40,886 per hectare.

The table below shows the approved rates at the time against the rates provided for 2021.