Budget 2022

Town Council approved the 2022 Operating and Capital Budget at its April 11, 2022 council meeting. Key information for the budget can be found on this page.

On this Page

-

Overview & Key Considerations

Overall budgets are back up to the 2019 levels, after 2 years of budget restrictions due to pandemic impacts on operations. Town Council maintained budgets to maintain a zero tax increase for the 2020 and 2021 year. Staffing levels and facility operations are back to pre-pandemic levels and the budget reflects this return to normal operations. However, aside from considerable inflation costs, there are some ways that the Town faces unique considerations this year.

Some key pressures that the Town faces for the 2022 budget are:

RCMP costs

Due to decisions made at the federal level, all Alberta municipalities need to cover retroactive pay that goes back five years, within the 2022 fiscal year. This, along with new costs of RCMP laboratory work, is about $400,000 and accounts for ~4% of the proposed 4.7% tax increase for 2022.

Waste disposal costs

Waste disposal costs are up 720%, due to a budget shortfall cost that are passed on to the Town by the Peace Regional Waste Management Company (PRWMC). For many years the Town benefited with a subsidized rate because of the oilfield industry utilizing the PRWMC. During the last few years, industry has scaled back, but the company’s costs have continued. This year the resulting shortfall has been passed on to the ownership partners of which the Town is a 3/7 owner. We are optimistic that 2023 will be a better year fiscally for the PRWMC, based on forecasted usage. The 2022 increase of $398K is equal to ~ a 4% increase to the tax rate.

The 2022 approved Net Municipal Tax Requirement of $11.82 million results in a 4.7 per cent municipal property tax increase. Administration has incorporated cost efficiencies, corporate adjustments and service level adjustments reducing the initial tax requirement of 13.7 to 4.7 per cent. As a result of a decision made at the April 11, 2022 Regular Council Meeting, the tax rate will be lowered to an increase of ~2%, offset by the reallocation of funds from the Disaster Recovery Program Reimbursement to the 2022 Operating Budget.

For more details on this decision, the council meeting highlights with attached audio is linked below.

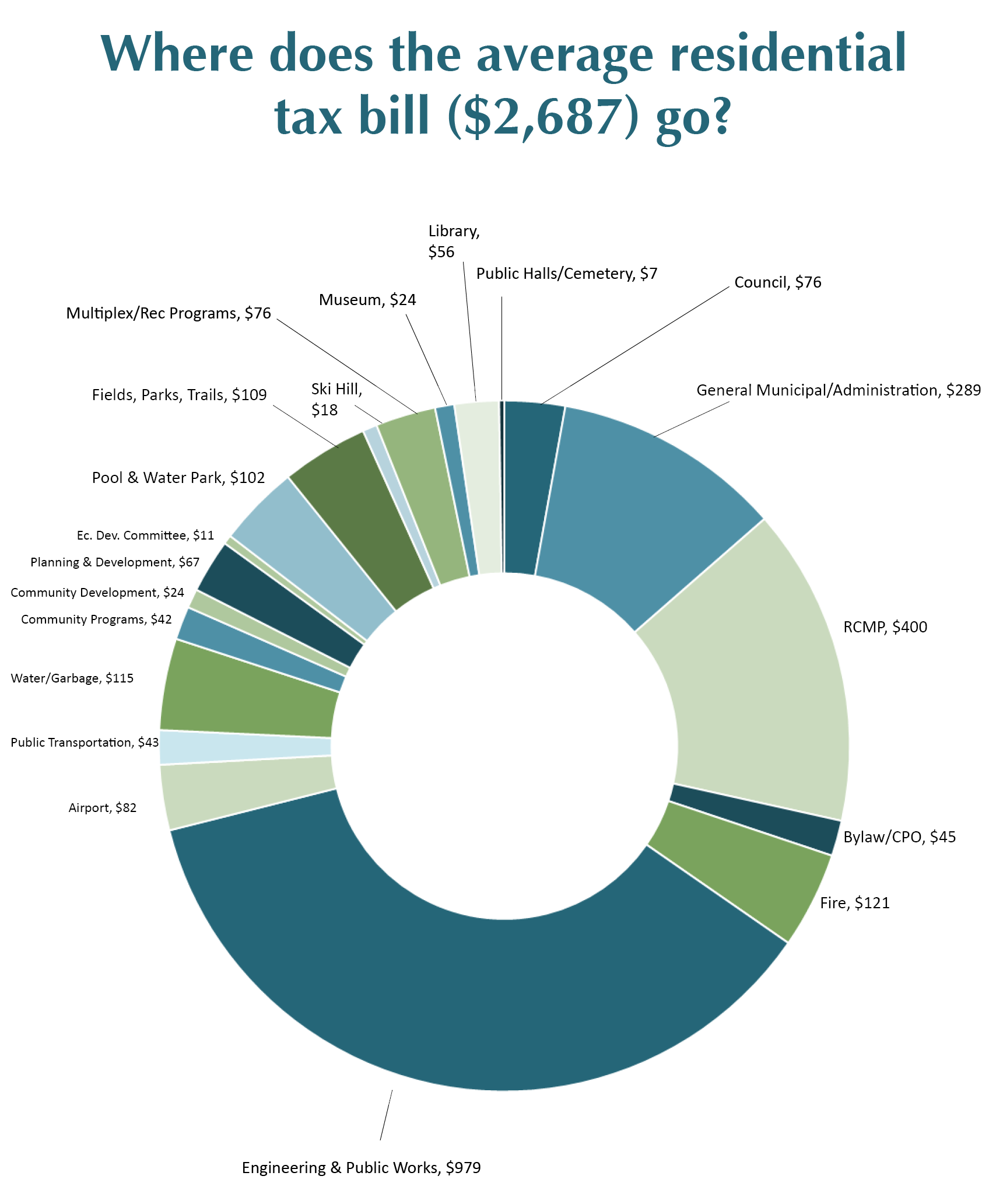

Below is a graph indicating how property tax, based on the average cost of a home in Peace River ($254,000), gets divided.

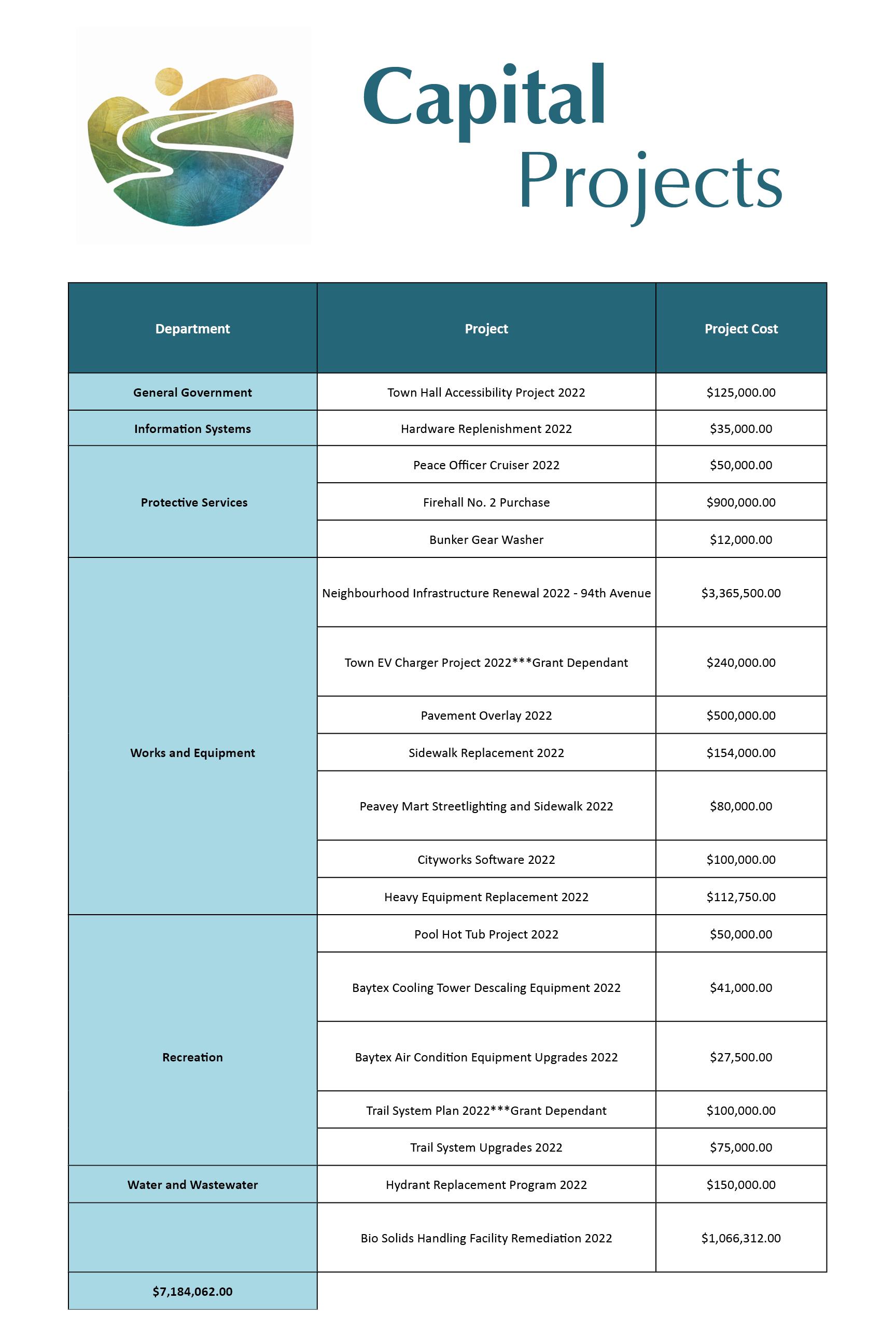

2022 Capital Budget

The Approved 2022 Capital Program includes 19 projects totalling $7.18 million.

Utility Budget

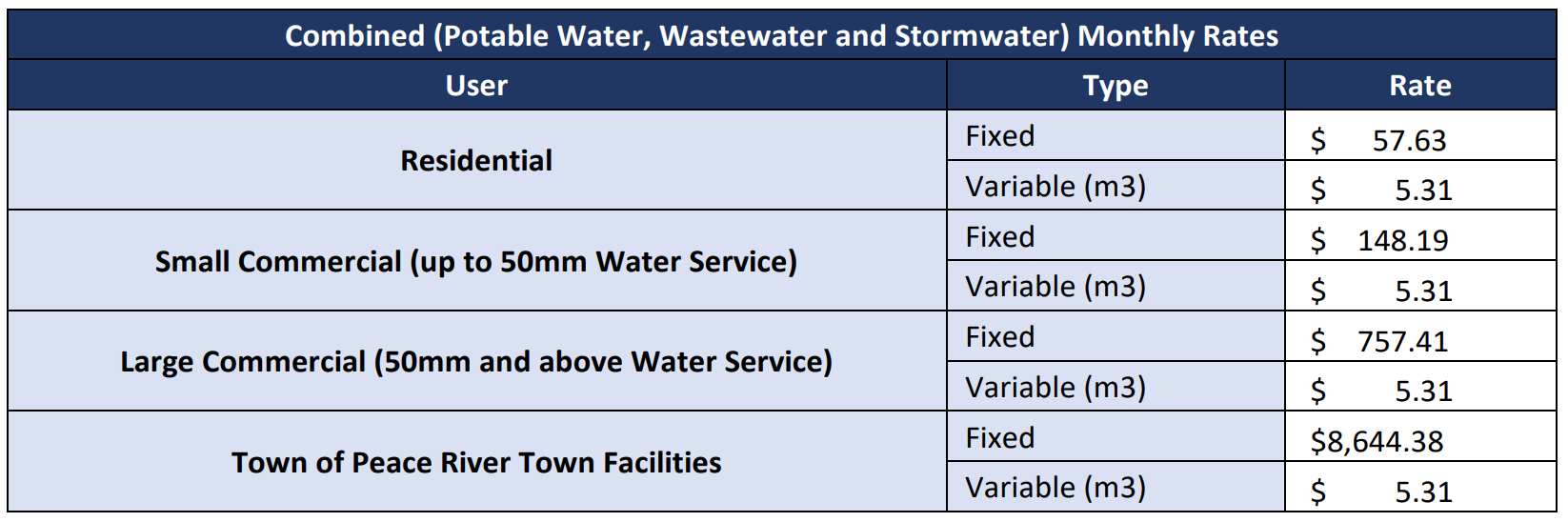

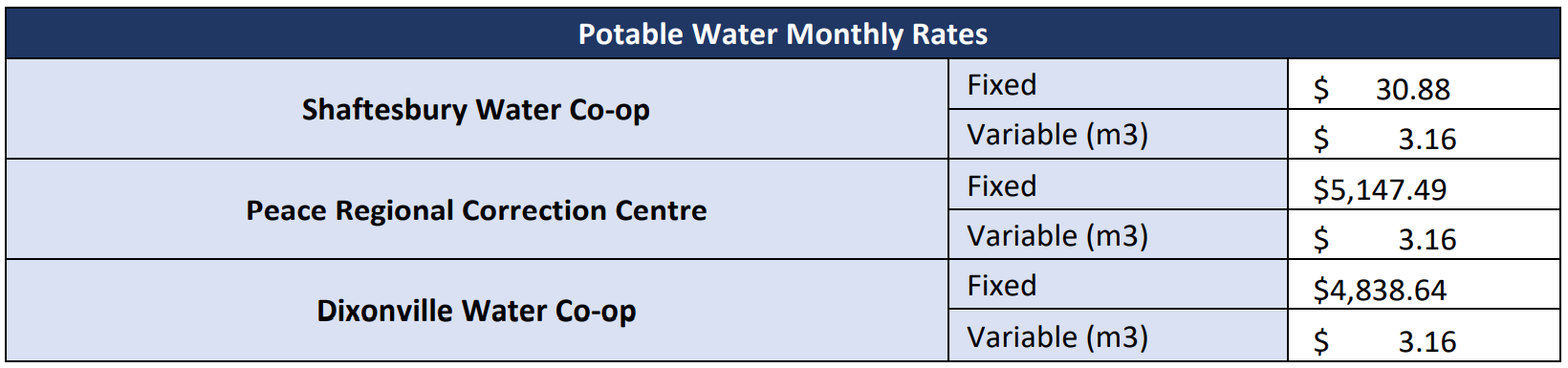

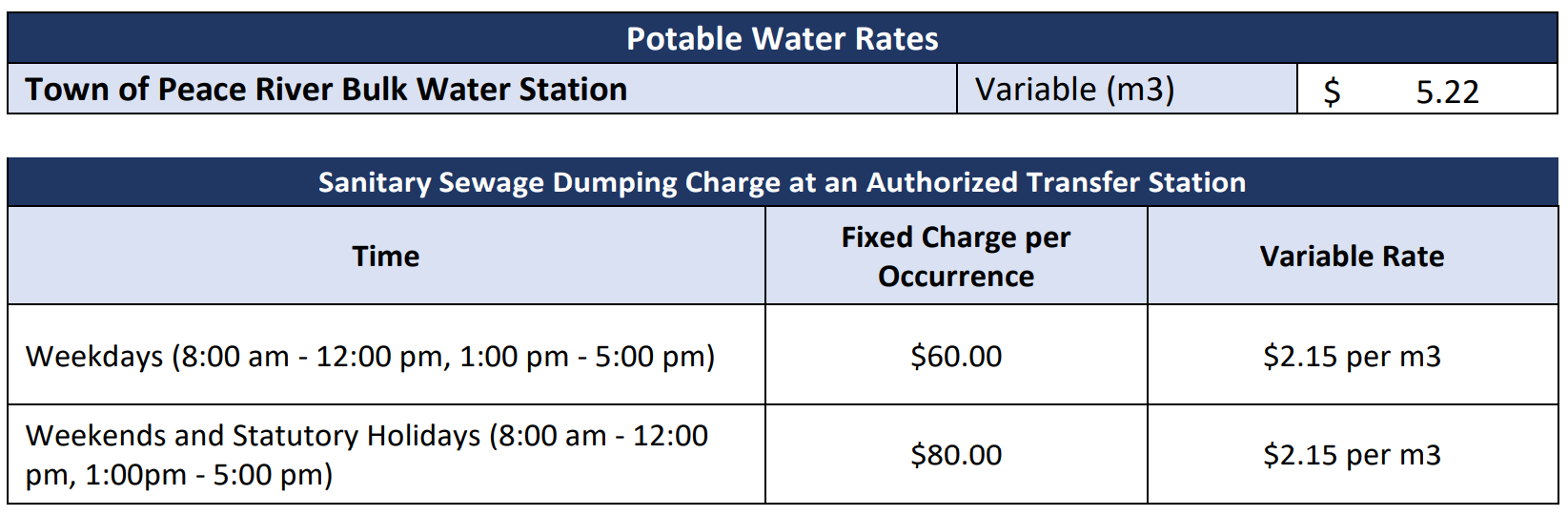

Water and wastewater operations provide for furnishing water and sanitary sewage disposal services to industrial, commercial and residential areas within the town and some surrounding areas.

As a part of the 2022 Budget process, the proposed full cost recovery model for water and $29 solid levy was presented and approved at the April 11, 2022 Regular Council Meeting. For the Request for Decision submitted, click or tap here: 2022 04 07 RFD re 2022 Operating and Capital Budget.pdf (civicweb.net)

As a result of the approved budget, water is switching to a full cost recovery model to be phased in over two years, starting July 15, 2022. This means that while the cost of water per m3 is going down from $6.60 to $5.31, there will be a fixed utility charge of $57.63 for residents. There will be a similar charge for commercial users.

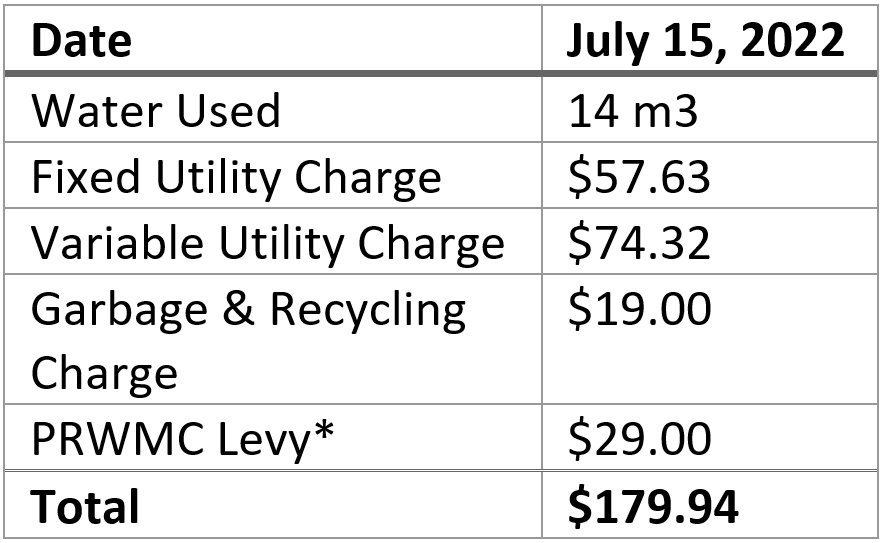

In terms of solid waste, the charge will be changing from $17 to $19, and a solid waste levy of $29 per month for six months will be imposed. These changes come into effect July 15, 2022.

Monthly Rates as of July 15, 2022

-

Why the changing water rates?

In the past the Town depended on the use of subsidies and raising water rates to cover infrastructure costs.

By switching to the new mixed rate, we are able to provide stable funding for essential infrastructure maintenance and upgrades. With this new model all residential utility accounts contribute an equal amount towards fixed system costs, while still encouraging water conservation. There’s a similar charge for commercial accounts.

Also important to note is that the Fixed Utility Charge in the new bills are costs that users are already paying in their property taxes. This reallocation of this cost to the water bill is done in the interest of transparency.

Why the changing utility rates and imposed levy?

The move from $17 to $19 for the solid waste utility rate (garbage and recycling charge) is based on the contractor (GFL) fees, Peace Regional Waste Management Company (PRWMC) charges, and landfill tipping fees. This is a fairly regular and expected increase.

A $29 PRWMC Levy will be added to utility bills for 6 months, starting July 15. This is a result of a $870,000 shortfall from PRWMC. This shortfall is a result of decreased industrial tipping fees over the last few years. As a 3/7 PRWMC owner, 3/7 ($373,000) of the shortfall has been passed onto the Town.

What will my new utility bill look like?

Based on the average amount of water consumption per household, the new utility bill for residents will look something like this:

* Only occurring for 6 months

- For a downloadable PDF version of the utility insert that discusses these changes, please click or tap the link: 2022 Utility Rate Changes

-

Questions?

Questions about the approved budget or process can be directed to Terry Websdale, Director of Corporate Services by emailing [email protected] or calling (780) 624-2574 ext. 1018.

Budgets from previous years